Efile Help

Premium Pro Enterprise has electronic filing capabilities for selected states that accept returns in an electronic format. TriTech helps facilitate the electronic filing of premium tax data and we work with all parties to do so. We do not have a preferred or recommended method of filing.

Currently, Enterprise supports two methods of electronic filing: E-filing via TriTech and E-filing via NAIC OPTins. With all available electronic filing methods, a basic validation process will occur before you will be allowed to submit the return data. Each state has some minimum requirements as well as unique criteria that need to be completed before submission. Please see the State Specifics topic for electronic filing requirements and further information.

E-filing via TriTech is a free submission option which has been designed to meet the specific filing requirements for various states that have agreed to collect premium tax data electronically.

- View or select the desired return in Enterprise.

- Fill out the return completely, just as you would a paper return and verify that all information is correct.

- When you are satisfied that all information is correct and complete, click the E-file via TriTech button on the return.

- A dialog box will appear stating that “You are E-filing the [State Return]”. You will be asked, “Do you want to Continue?” Answer accordingly.

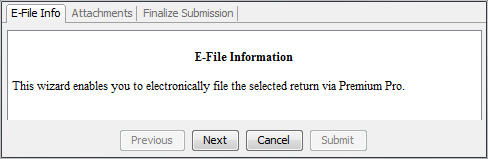

- When you select Yes to proceed, an e-file

wizard will appear to assist you in completing

the electronic filing process.

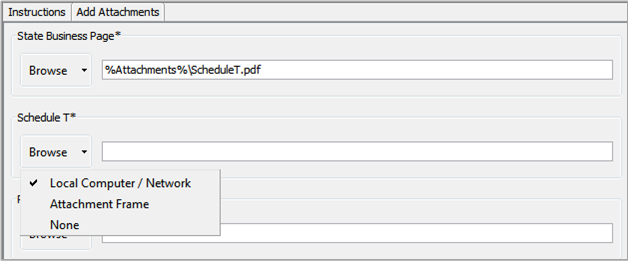

On the initial E-file Info tab, click Next to proceed. The Attachment Tab allows you to include attachments with your filing. This may include supporting documentation for credits, requests for refunds, etc. You can add or remove attachments as necessary using the appropriate buttons.

Any attachment with an asterisk is required and must be attached before you can submit your filing. Some of the attachments may already include a path to a file if you previously added items to your return via the Attachment Frame and designated the document as an E-file Attachment. To include or edit an attachment, click the down arrow next to the browse button to specify a location: Local Computer/Network, Attachment Frame, or None. Browse to the desired file and select OK or Open.

- Click Submit to complete the process.

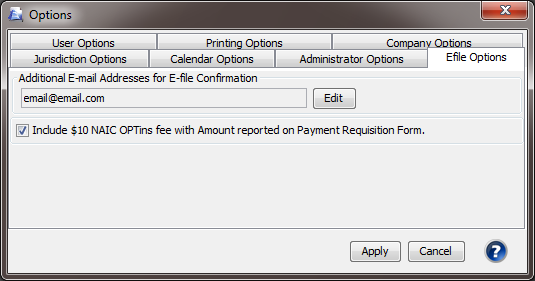

You may need to allow a few moments for the encrypted data to transfer. You should then see a message stating that the file transfer is complete. Soon after, an email confirming the transmission of the file will be sent to the contact email address provided on the return as well as any additional contacts listed on the efile options tab. Tools>Options>Efile

The electronic submission of the return is the official filing. It is not necessary to mail a printed copy.

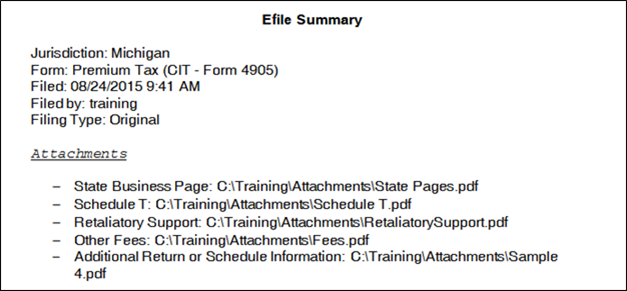

A PDF version of the electronically filed return will also be saved to the attachment frame under an E-filed Returns folder for your records. The PDF will include an Efile Summary that summarizes the transmission. Efiled PDF attachments are also printed to the Attachment Frame. In addition, sub-forms, such as the CT-33-M filed with CT-33 for NY, will be printed to the Attachment Frame.

A visual indicator, a green ‘e’, will appear beside the return name in the active tree for filings that have been successfully transmitted.

Both failed and successfully transmitted electronic filings will be noted in the Actions report. When applicable, the e-file submission ID will also be recorded in the report.

For some states, you will receive additional email notifications regarding either the state’s acceptance or rejection of your filing. See the state specifics for additional information.

E-filing via NAIC provides you with the ability to submit filings to select states that are participating in the NAIC OPTins program. Instructions are provided below.

Steps for E-filing through NAIC

To electronically file your returns through the NAIC, you must first register to use OPTins and EFT for payment of premium taxes. You will need to contact the OPTins Marketing Department at 816-783-8787 or optinsmktg@naic.org for more information. You may also visit the OPTins website at http://www.optins.org/. Once registered, please follow the steps below to electronically file your return.

- View the desired return in Enterprise.

- If you are filing a non-mandatory state, check the box at the top of page one of the return to indicate that you plan to electronically file the return using the E-file via OPTins feature.

- Fill out the return completely, with all company information, premiums, and other required information, just as you would a paper return. Verify that all information is correct.

- When you are satisfied that all information is correct and complete, go to the first page of the return and press the "E-file via OPTins" button.

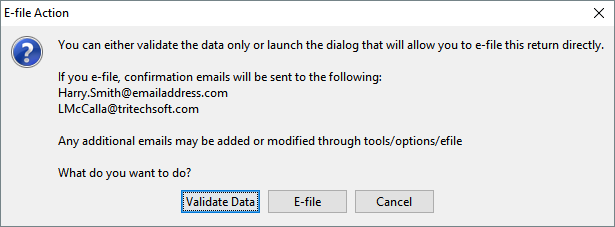

- An Efile Action Dialog will appear and give you the option to Validate Data, E-file, or Cancel.

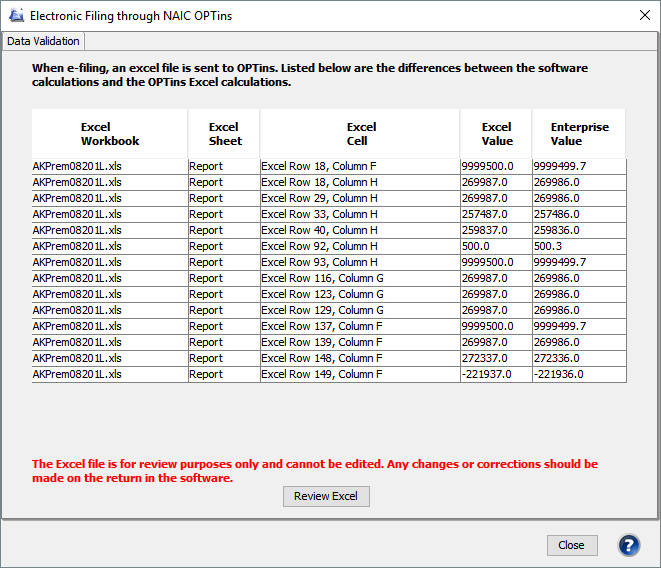

- If you select Validate Data, the software will display any differences between the software values (including overridden values) and the OPTins Excel calculations. This will allow you to determine if any changes or correction should be made on the return in the software before proceeding.

- If you click the Review Excel button, the

OPTins Excel version of the return will load

and any differences will be highlighted in

yellow.

Please note that this is for review purposes only and cannot be edited. Select close to close the Data Validation. If you select the Efile Button, the NAIC OPTins Efile Wizard will appear. The first tab is the Data validation and displays the same information you reviewed in the previous steps.

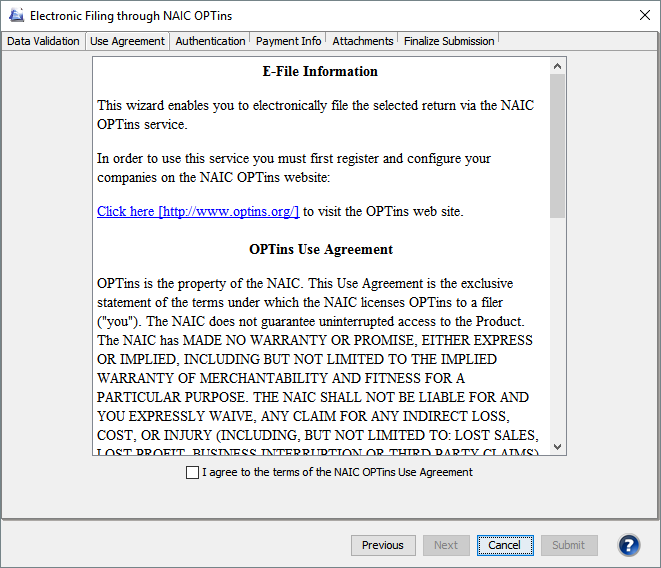

- On the next tab, review the OPTins Use Agreement and select “I agree to the terms of the NAIC OPTins Use Agreement” to enable the Next button.

- On the Authentication Screen, verify the Company Information section and enter your OPTins username and password previously provided by the NAIC. Click the button to verify the information.

- When the user name and password are authenticated, you can proceed by selecting the Next button. You can also check the Remember Me box on this screen to prevent having to reenter your login information each time you go through the OPTins wizard. Please note that the login information is user specific.

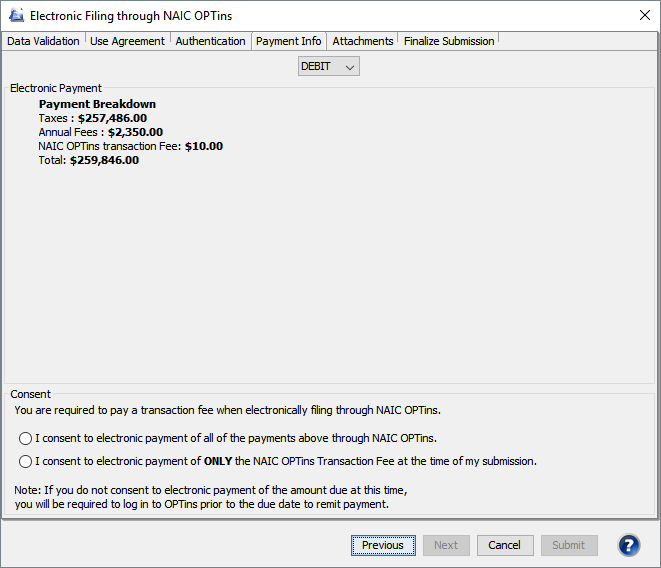

- On the Payment Information tab, choose

whether you are paying via Debit or Credit

from the dropdown box. The payment breakdown

shows the tax due amount, the OPTins transaction

fee, and the total amount due.

- If

you choose Debit, review the payment breakdown

then:

- Consent to the payment of either ALL of the payments or ONLY the NAIC OPTins Transaction Fee at the time of submission. If you choose to consent to the payment of the transaction fee only, you will need to remit payment directly from the OPTins system before the due date of the return.

- You must agree to pay the transaction fee before you can proceed with the filing.

- Your filing is considered filed with the state upon submission when choosing the Debit option.

- Click Next.

- If

you choose Debit, review the payment breakdown

then:

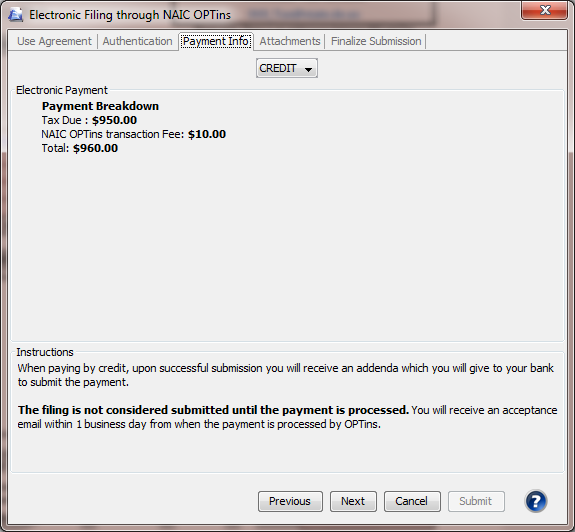

- If

you choose Credit, review the payment

breakdown then select Next.

- Upon successful submission, you will receive an addenda record which you will give to your bank to submit the payment. The filing is not considered submitted until the payment is processed. You will receive an acceptance email within one business day from when the payment is processed by OPTins.

- If

you choose Credit, review the payment

breakdown then select Next.

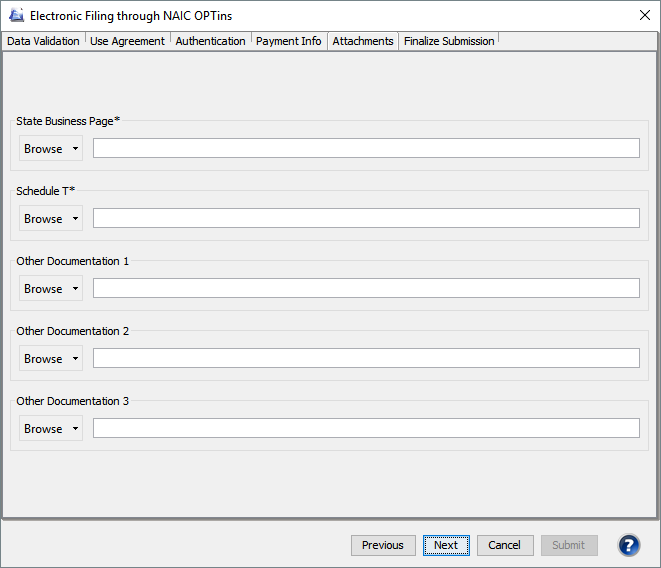

- The Attachment tab allows you to include

any file type as an attachment. This may include

scanned signature pages, supporting documentation

for credits, requests for refunds, etc. You

can add or remove attachments as necessary

using the appropriate buttons.

Any attachment with an asterisk is required and must be attached before you can submit you filing.

Some of the attachments may already include a path to a file if you previously added items to your return via the Attachment Frame and designated the document as an E-file Attachment. To include or edit an attachment, click the down arrow next to the browse button to specify a location: Local Computer/Network, Attachment Frame, or None. Browse to the desired file and select OK or Open.

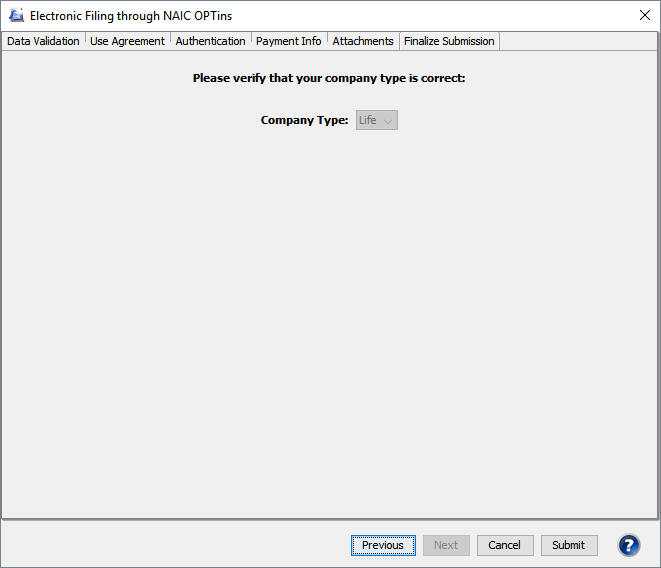

- On the last tab, Finalize Submission, if applicable, you must select your appropriate company type from the dropdown box.. Once you have selected your company type and reviewed the Excel file, click on the Submit button.

- You will receive a submission message stating that the filing was submitted successfully. The electronic submission of the premium tax return is the official filing. It is not necessary to mail a hard copy of the premium tax return.

You may need to allow a few moments for the data to transfer. You should then see a message stating that the file transfer is complete. Soon after, an email confirming transmission of the file will be sent to the contact email address provided on the return and any email addresses included on the efile options tab. A PDF version of the electronically filed return will also be saved to the Attachment Frame under an E-filed Returns folder for your records. The PDF will includes an Efile Summary that summarizes the transmission. Efiled PDF attachments are also printed to the Attachment Frame.

The PDF generated for e-filed returns now uses the pdf print naming convention. Tools>Printing Options>Print Job Name

For OPTins states, the NAIC Banking info (bank name, account number and routing number) will be included in the efile summary and in the email confirmation.

A visual indicator, a green ‘e’, will appear beside the return name and each sub-form that was part of the efiling in the active tree for filings that have been successfully transmitted.

Both failed and successfully transmitted electronic filings will be noted in the Actions Report.

If you chose to pay via Credit, you will receive another email when the payment has been processed. At that point, the return is submitted to the state.

Some states also have the option to create a file that can in turn be used to populate the state’s online system with data from the tax return in the software.

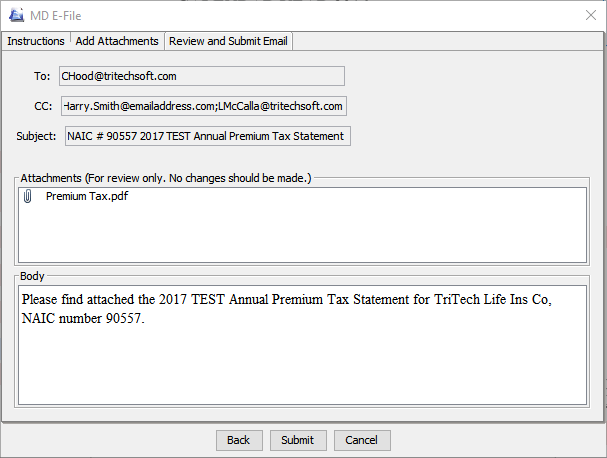

Some states (Alabama, DC, Maryland, Nevada, and Ohio have an email option. Selecting this button prints a copy of the return to PDF and generates and email addressed to the state with the necessary identifying information and return attached. When you select the Email This Return button, an email wizard will appear. The Attachment tab allows you to include any file type as an attachment. This may include scanned signature pages, supporting documentation for credits, requests for refunds, etc. You can add or remove attachments as necessary using the appropriate buttons.

A warning will now pop up when you try to email previously emailed returns, and a pop up message will inform you if you do not have a username and password entered in the Login Schedule.

Any attachment with an asterisk is required and must be attached before you can submit you filing. Some of the attachments may already include a path to a file if you previously added items to your return via the Attachment Frame and designated the document as an E-file Attachment. To include or edit an attachment, click the down arrow next to the browse button to specify a location: Local Computer/Network, Attachment Frame, or None. Browse to the desired file and select OK or Open.

On the Review and Submit Email tab, you may double click on the items listed in the Attachments section to review the PDFs that will be submitted. The email addresses the filing will be sent to, subject, and body of the email are visible as well on this tab.

Clicking the submit button will send the email.

Users have the option to designate additional email address(es) to receive copies of the e-file confirmation emails. Tools>Options>Efile

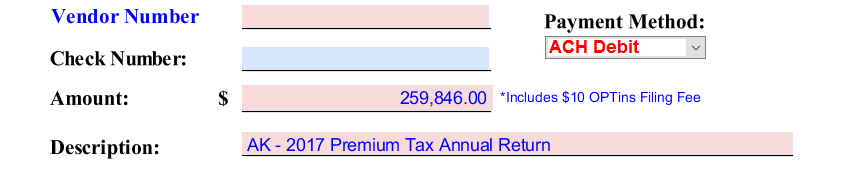

You may check the option that says 'Include $10 NAIC OPTins fee with Amount reported on Payment Requisition Form' in order to include the $10 NAIC fee in the total amount listed on the Payment Requisition form. A label reading *Includes $10 OPTins Filing Fee will be enabled as well indicating that the fee has been added.

Our website address: www.tritechsoft.com

Our mailing address: 1205 S. Greenville Ave, Allen, TX 75002.

Questions? You can reach us at 1-800-380-6407

Or contact WebSupport here.

©1995-2018 TriTech Software Development Corp. ©2006-2018 TriTech Services Inc. All rights reserved. Premium Pro® is a registered trademark.